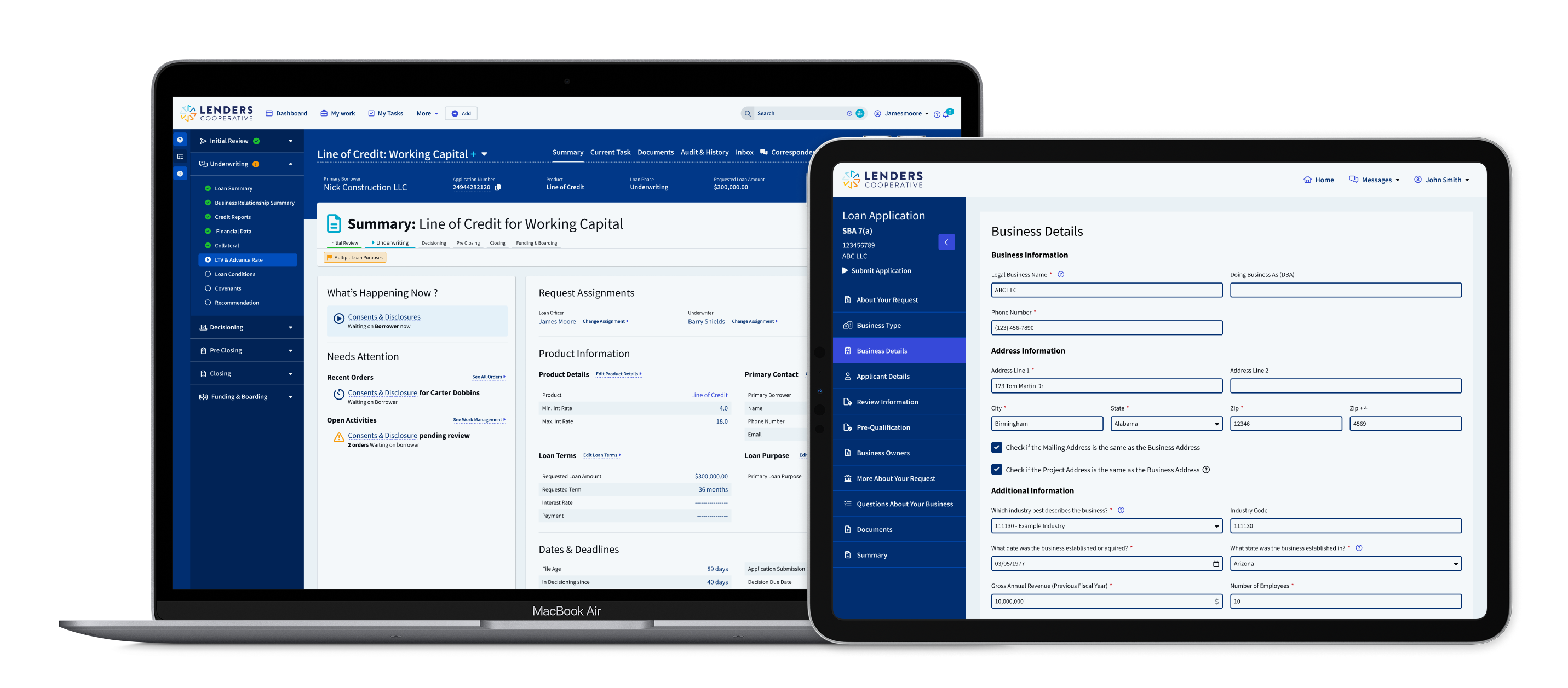

The only platform in the market that automates and manages the complete loan life cycle from application to servicing.

Release 9.6.9: Primary Contact, Credit Bureau, and Document Enhancements

At Lenders Cooperative, we’re committed to keeping our clients ahead of the curve. Our team is constantly enhancing the Unified Lending Platform to deliver the flexibility, compliance, and user experience today’s lenders need. The latest Release 9.6.9 is another step forward—introducing targeted updates that streamline workflows and strengthen borrower and lender interactions.

What’s New:

Smarter Borrower Experience with a Dedicated Primary Contact Tab

Managing borrower contact information is now simpler and more accurate. The new Primary Contact tab makes it easy to select an owner or add a new contact, while smart validations and pre-populated details ensure data integrity. These improvements reduce manual work and give lenders and borrowers a smoother, more consistent experience.

Improved Credit Bureau Review and FACTA Integration

Credit checks just got more efficient. The enhanced Credit Bureau Review task provides clear recommendations when encountering frozen or locked credit reports—whether that means repulling credit or editing borrower relations. Plus, FACTA updates are now seamlessly integrated into the review task, eliminating extra steps and keeping compliance workflows streamlined.

Enhanced Document Capabilities for Compliance & Transparency

Release 9.6.9 expands document functionality to meet evolving regulatory requirements. New state-specific commercial financing disclosures support Community Development Financial Institutions (CDFIs) and other non-bank lenders, while an enhanced SBA 1919 pre-closing package removes redundant paperwork already captured digitally. These updates help lenders maintain compliance while improving clarity for borrowers.

Driving Innovation for the Future of Lending

Our mission is to help financial institutions stay competitive and future-ready. Every release reflects our ongoing investment in innovation—so our clients can focus on building relationships and growing their business, knowing their lending platform is evolving with their needs.

A Unified Lending Platform

Request a Demo

Experience the New Features Firsthand

Request a personalized demo today.