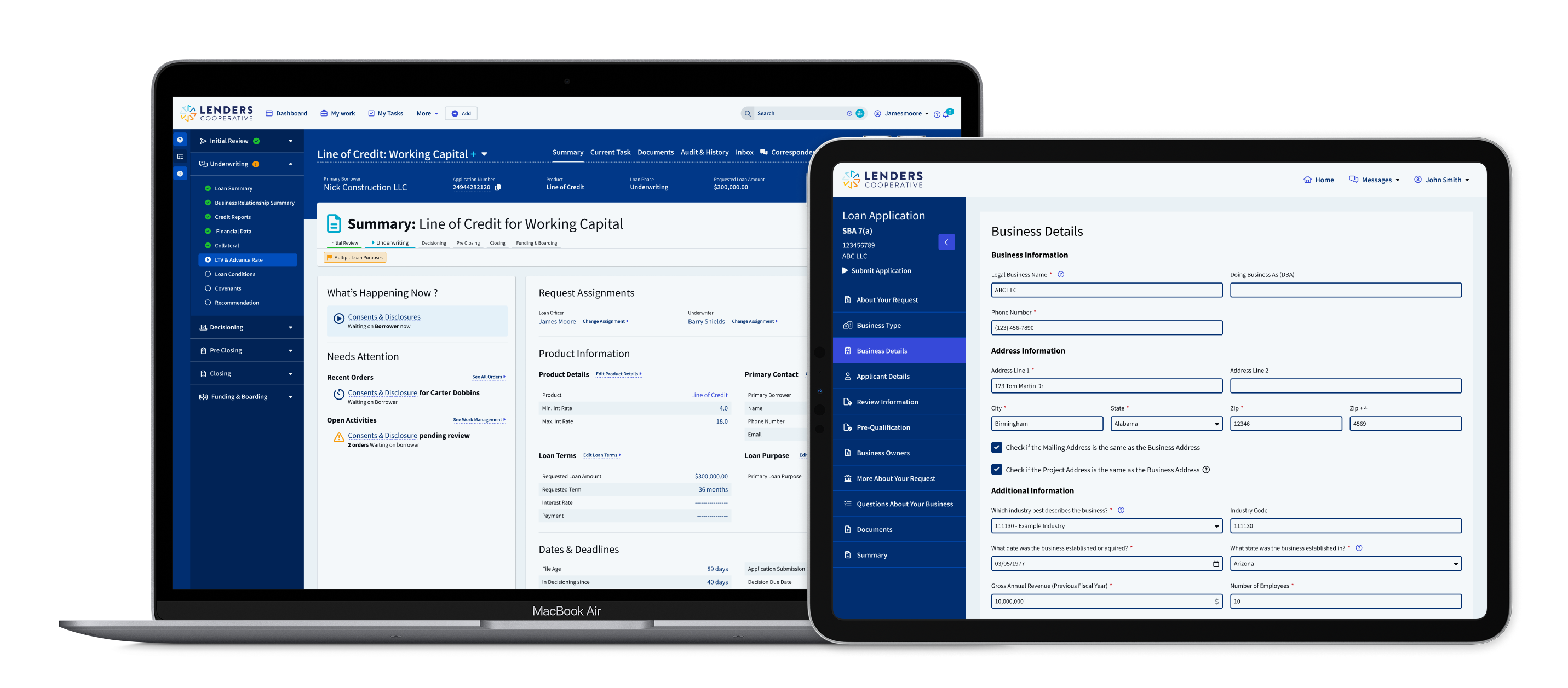

The only platform in the market that automates and manages the complete loan life cycle from application to servicing.

Release 9.6: Expanding Flexibility and Efficiency for Lenders

On August 20, 2025, we released version 9.6 of the Lenders Cooperative Lending Platform. This release builds on our mission to provide banks and credit unions with a modern, end-to-end solution for business lending. With new functionality, expanded product support, and workflow enhancements, Release 9.6 is designed to give lenders more flexibility, efficiency, and confidence in serving their clients.

What’s New in Release 9.6

Broker Portal

We’ve added a Broker Management Portal that empowers brokers to submit loan applications on behalf of borrowers.

- Create and manage broker agencies and agents

- Allow brokers to initiate applications and upload documents

- Provide brokers with a dashboard to track applications and statuses

This new workflow extends lender reach while maintaining visibility and control throughout the process.

Business Credit Card Applications

Small businesses can now apply for business credit cards directly within the platform.

- Borrowers can add cardholders and allocate funds

- Lenders can review cardholder details and set limits

- Cardholder data can be securely exported for fulfillment

This enhancement opens new product opportunities and makes it easier for lenders to expand their portfolio.

Credit Memo Review Task

A new Credit Memo Review step has been added to the workflow to streamline collaboration and accuracy.

- Greater assurance that credit memos are complete and compliant

- Configurable review step integrated into the loan application process

- Option to send credit memos back for correction during Level 2 review

SBA Loan Processing Enhancements

Release 9.6 introduces important updates aligned with SBA SOP 50 10 8 requirements and lender feedback:

- Support for leased spaces in collateral processing

- Automated generation of the Seller’s Financial Certificate for acquisitions

- Adjusted loan terms for real estate use of proceeds

- Enhanced handling of spousal ownership

- Full support for SBA E-Tran v9.0

These updates ensure smoother SBA loan origination and compliance across the platform.

Additional Enhancements

Beyond the headline updates, Release 9.6 includes:

- User interface consistency improvements across Work Management tasks

- Odd-days interest collection method options on the Pricing Screen

- Automated flood search and improved SLA tracking

- Pre-closing document flexibility in Doc Prep tasks

- Updated Lumos 2.0 scoring API integration for improved predictive accuracy

Looking Ahead

This release reflects our commitment to building a flexible, secure, and modern lending platform based on direct client feedback and industry needs. Future updates will continue to expand automation, enhance user experience, and support new loan products.

Stay tuned for upcoming demo videos and walkthroughs highlighting these new features in action.

A Modern Lending Platform

Stay Compliant. Lend Smarter.

See the 9.6 Updates in Action

Request a personalized demo today.